Intel’s $4.1 Billion Turnaround: Sizable Investments Anchor Foundry Business Strategy

Intel’s Financial Reversal and Capital Influx

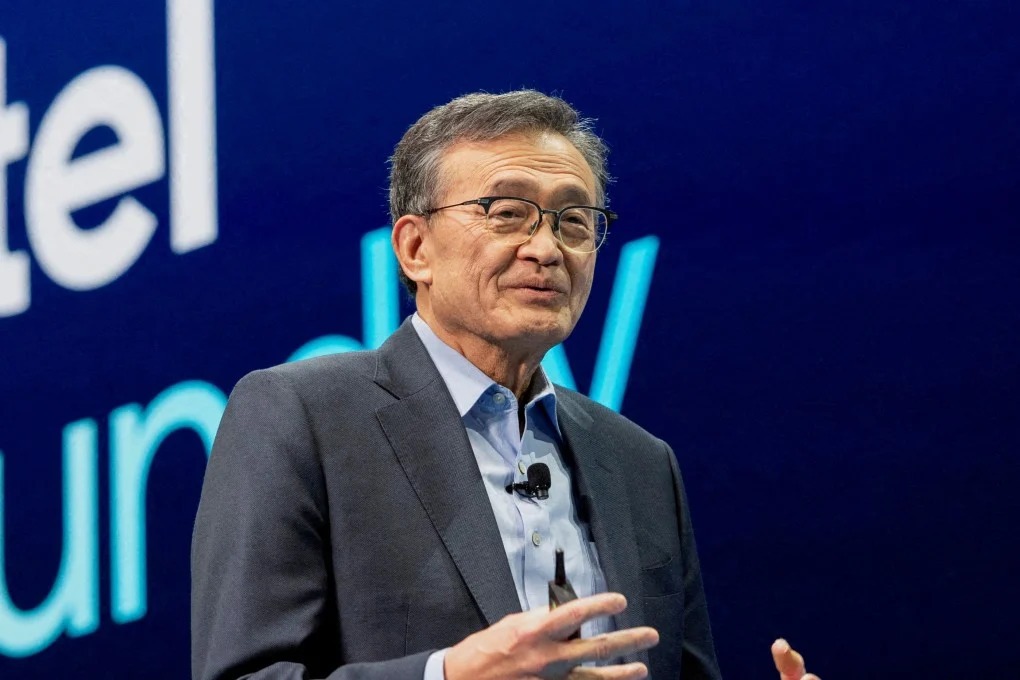

Intel recently reported third-quarter earnings that surpassed Wall Street expectations. This positive result was driven by increased revenue and larger cost reductions. CEO Lip-Bu Tan aims to revitalize the struggling semiconductor giant. The company reported $\$4.1$ billion in net income for the quarter. This is a dramatic reversal from the $\$16.6$ billion loss in the same period last year.

The company’s recovery story is complex. It involves significant cost cutting through layoffs and strategic, high-profile investments. Intel announced an addition of $\$20$ billion to its balance sheet during the third quarter. This capital growth stemmed largely from three sizable investments over the preceding three months. In August, SoftBank invested $\$2$ billion. The U.S. Government then took an unprecedented $10\%$ equity stake. The company has received $\$5.7$ billion of a planned $\$8.9$ billion from the government so far. Furthermore, Nvidia purchased a $\$5$ billion stake in September. This was part of a broader chip development deal. Tan stated these actions provide greater operational flexibility. They position Intel to execute its Intel foundry business strategy with confidence. He also noted the government’s support highlights Intel’s strategic role as the only U.S.-based semiconductor company with leading-edge manufacturing.

Strategic Asset Divestment and Revenue Growth

Beyond external investments, Intel strengthened its financial position through asset sales. The company closed the sale of its ownership stake in Altera on September 12. Altera is a hardware company Intel had owned since 2015. This sale provided $\$5.2$ billion in funding. Intel also successfully sold its stake in Mobileye, an autonomous driving technology firm.

These divestments and cost controls contributed to notable revenue growth. Intel grew its quarterly revenue by $\$800$ million. It reached $\$13.7$ billion in the third quarter, up from $\$12.9$ billion. Despite the strong quarterly performance, the company was sparse on details regarding the immediate future of its foundry business. This segment focuses on making custom chips for external customers. The foundry business has struggled since its inception. This makes the future of the Intel foundry business strategy a central point of scrutiny.

Foundry Business: The Long-Term Growth Anchor

Wall Street analysts consider the foundry business crucial for Intel’s long-term growth. Experts previously stated the company did not need cash for a turnaround. Instead, it required a clear strategy to get its foundry operations on track. The U.S. government’s investment reinforces the business’s strategic importance. A key condition of the government’s equity stake includes language to penalize Intel if it divested from the foundry business over the next five years.

CEO Tan stated that the Intel foundry business strategy is uniquely positioned. It aims to capitalize on the swelling demand for custom chips. However, he offered few specifics on execution. Tan noted the company is actively engaging with potential customers. He also emphasized that the foundry’s expansion would remain disciplined. Building a world-class foundry is a long-term effort founded on trust. The company must ensure its process is easily used by a variety of customers. They must meet all customer needs for performance, yield, cost, and schedule.

What specific actions and customer acquisitions will be required to prove the long-term viability of this strategically protected foundry operation?

Explore Business Solutions from Uttkrist and our Partners, Pipedrive CRM [2X the usual trial with no CC and no commitments] and more uttkrist.com/explore