Nvidia Groq licensing deal reshapes the AI chip race

A non-exclusive agreement brings Groq’s LPU technology and senior leadership into Nvidia’s ecosystem.

Introduction

The Nvidia Groq licensing deal marks a significant shift in the competitive landscape of AI hardware.

In this agreement, Nvidia will license technology from AI chip challenger Groq and hire its top executives.

The deal is non-exclusive.

However, it carries strategic weight as demand for AI computing power continues to accelerate.

What the Nvidia Groq licensing deal includes

Under the Nvidia Groq licensing deal, Nvidia will bring in Groq’s founder Jonathan Ross, its president Sunny Madra, and additional employees.

CNBC reported that Nvidia is acquiring assets from Groq for $20 billion.

Nvidia clarified that this is not an acquisition of the company and did not comment on the scope.

If accurate, the reported figure would make this Nvidia’s largest purchase to date.

Why Groq’s LPU technology matters

AI companies increasingly compete on speed, scale, and energy efficiency.

Nvidia’s GPUs dominate this market today.

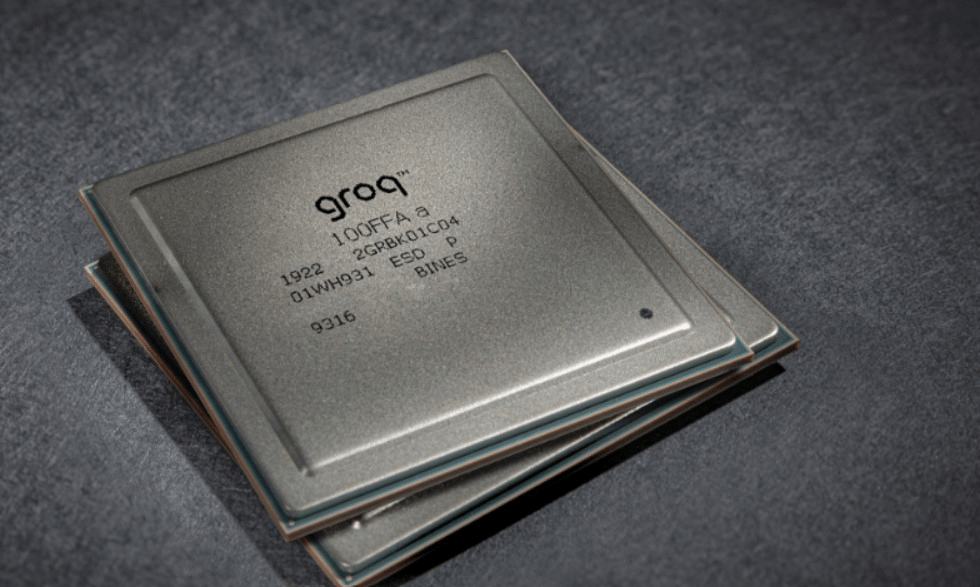

Groq, however, has developed a different architecture.

Its language processing unit, or LPU, is designed specifically for large language models.

Groq has claimed its LPUs can run LLMs ten times faster while using one-tenth the energy.

These claims sit at the core of the Nvidia Groq licensing deal.

Leadership experience behind the deal

Jonathan Ross is closely associated with advanced AI accelerators.

Before founding Groq, he worked at Google, where he helped invent the tensor processing unit.

That background reinforces why Nvidia values Groq’s technical direction.

It also explains why leadership hires are central to the agreement, not just the technology.

Groq’s rapid growth before the agreement

Groq’s scale expanded quickly ahead of the Nvidia Groq licensing deal.

In September, the company raised $750 million at a $6.9 billion valuation.

Groq reported that it powers AI applications for more than two million developers.

That figure rose sharply from roughly 356,000 developers the previous year.

Such growth highlights why Groq emerged as a credible challenger in AI chips.

Strategic implications for the AI chip market

The Nvidia Groq licensing deal reinforces Nvidia’s position in AI infrastructure.

At the same time, it signals openness to alternative chip architectures.

This approach allows Nvidia to benefit from Groq’s innovation without full acquisition.

It also tightens Nvidia’s grip on the broader AI computing stack.

For enterprises tracking AI hardware strategy, this deal sets a clear direction.

Business perspective

For organizations navigating AI transformation, hardware choices increasingly shape outcomes.

Strategic partnerships now matter as much as internal R&D.

Explore the services of Uttkrist, our services are global in nature and highly enabling for businesses of all types, drop us an inquiry in your suitable category: https://uttkrist.com/explore

Closing thought

As AI workloads grow more complex, will licensing-driven partnerships define the next phase of chip innovation?

Explore Business Solutions from Uttkrist and our Partners’, Pipedrive CRM [2X the usual trial with no CC and no commitments] and more uttkrist.com/explore