Kodiak Bosch Autonomous Trucks Partnership Drives Scalable Driverless Freight

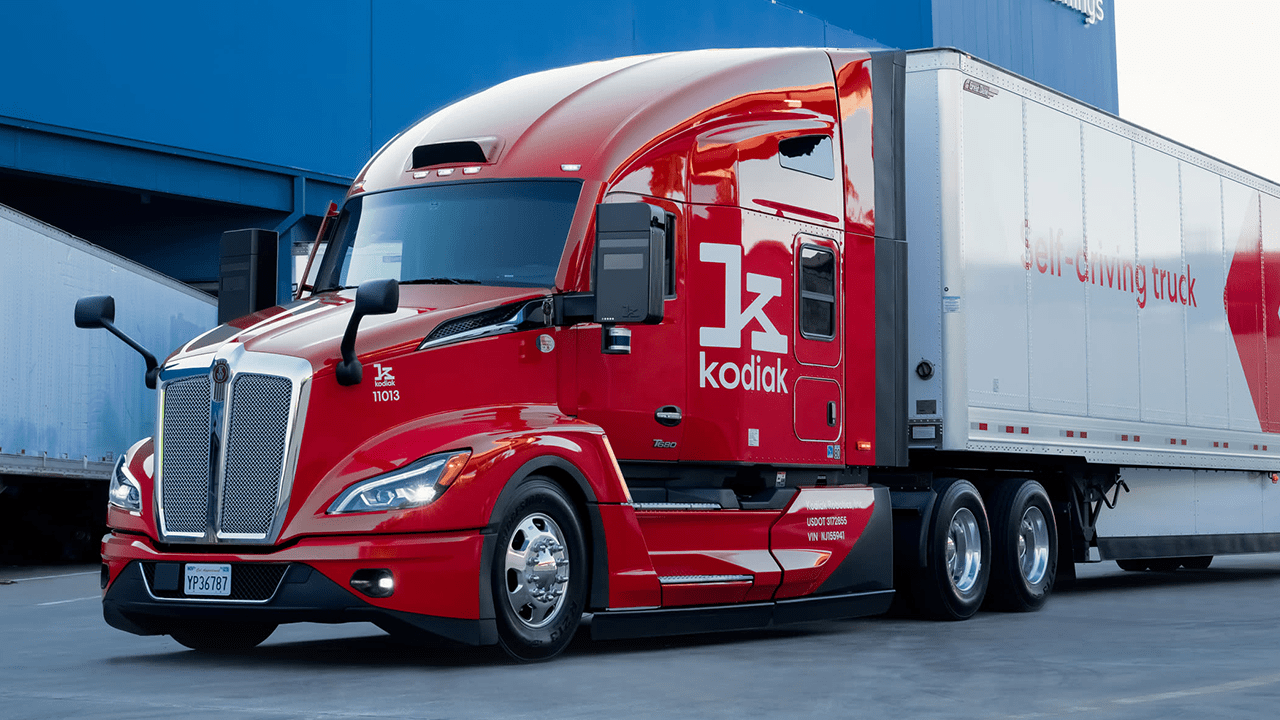

The Kodiak Bosch autonomous trucks partnership reflects a focused effort to scale autonomous trucking using production-ready systems. The collaboration brings together Kodiak’s self-driving software platform and Bosch’s automotive-grade hardware capabilities. Its objective is clear: enable autonomous driving on standard semi trucks, regardless of manufacturer.

The partnership was announced at the 2026 Consumer Electronics Show in Las Vegas. It centers on building integrated hardware and software platforms that can be deployed at scale. These systems are designed for factory-line installation or later integration by third-party upfitters. As a result, the approach prioritizes flexibility, serviceability, and commercial readiness.

Kodiak has already developed a self-driving system with redundancy across braking, steering, sensors, and computing. This foundation allows the company to shift its focus from validation to expansion. The Kodiak Bosch autonomous trucks collaboration is positioned as a scaling move rather than a technical experiment.

Commercial Operations Validate the Model

Kodiak’s autonomous trucking efforts are not limited to testing environments. In January 2025, its self-driving trucks began making driverless deliveries for Atlas Energy Solutions. These operations took place in the Permian Basin of West Texas and eastern New Mexico.

Since then, Kodiak has delivered at least eight autonomous trucks to Atlas Energy. These vehicles are part of an initial 100-truck agreement between the two companies. Roush Industries served as the upfitter for the delivered trucks, supporting real-world deployment.

This operating history demonstrates that the technology has moved beyond pilot stages. However, broader adoption requires standardized hardware capable of mass deployment. That requirement explains the strategic importance of the Kodiak Bosch autonomous trucks partnership.

Modular Hardware for Fleet-Scale Deployment

Under the collaboration, Bosch will supply a range of hardware components. These include sensors and vehicle actuation technologies such as steering systems. Together, the companies will develop redundant platforms that convert semi trucks into driverless vehicles.

A key feature of this approach is modularity. The systems can be integrated during vehicle production or added later by third-party upfitters. This flexibility lowers adoption barriers for fleets and manufacturers. It also supports long-term service and maintenance needs.

Kodiak’s leadership has emphasized that system-level integration is critical for commercial success. The partnership reflects a practical focus on reliability and scalability rather than rapid market announcements.

Organizations evaluating similar industrial-scale technology shifts often require structured guidance. In this context, businesses can explore enabling services and advisory capabilities at https://uttkrist.com/explore/, where global frameworks support complex operational transitions.

Strategic Context and Market Implications

Kodiak’s scaling strategy follows its public listing in September 2025. The company went public through a merger with Ares Acquisition Corporation II. This transition adds urgency to demonstrate repeatable growth and commercial execution.

For Bosch, the partnership offers exposure to real-world autonomous trucking operations. By supplying production-grade hardware, Bosch deepens its position within the autonomous mobility sector. The collaboration also enables Bosch to refine its offerings based on operational data.

Notably, neither company has provided a timeline for production availability. The absence of a defined schedule highlights the complexity of industrializing autonomous trucking at scale.

What the Partnership Signals for Autonomous Freight

The Kodiak Bosch autonomous trucks partnership underscores a shift toward infrastructure-led autonomy. The emphasis on redundancy, modular design, and manufacturer-agnostic integration reflects a commercial mindset. Autonomous capability is framed as an extensible system, not a custom build.

For fleet operators and logistics stakeholders, this approach could reshape investment decisions once deployment timelines become clearer. As adoption progresses, structured insight and ecosystem-level support will remain essential.

Platforms such as https://uttkrist.com/explore/ exist to help organizations assess and navigate such technology-driven transitions across strategy, operations, and execution.

As autonomous trucking moves closer to scale, the real measure of progress will emerge on operational routes, not announcement stages.

How will manufacturer-agnostic autonomy influence long-term fleet modernization strategies?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore