Trump Venezuela oil deal reshapes short-term U.S. energy strategy

President Donald Trump said Venezuela will sell between 30 million and 50 million barrels of oil to the United States at market price. This Trump Venezuela oil deal immediately places energy supply back at the center of U.S. foreign and economic policy. According to Trump, proceeds from the sale would benefit people in both countries.

However, the announcement came amid heightened geopolitical tension. Earlier, U.S. forces carried out a military operation that captured Nicolás Maduro. As a result, the oil deal cannot be viewed in isolation. Instead, it intersects directly with diplomacy, security, and market stability.

How the Trump Venezuela oil deal fits into U.S. oil demand

At the time of the announcement, oil was trading at roughly $56 per barrel. Therefore, the transaction could be valued at up to $2.8 billion. Even so, the scale remains limited. The United States consumes around 20 million barrels of oil and related products per day. Consequently, Venezuela’s supply would cover at most two and a half days of U.S. demand.

Nevertheless, the Trump Venezuela oil deal still matters. It signals flexibility in sourcing and highlights short-term supply buffering rather than long-term dependency. In addition, it reinforces how energy decisions are being used as immediate policy tools.

Venezuela’s oil capacity versus its reserves reality

Although Venezuela holds the world’s largest proven crude oil reserves, its actual production tells a different story. The country produces about one million barrels per day. By comparison, U.S. daily production averaged 13.9 million barrels during October.

As a result, reserves alone do not translate into market power. Instead, infrastructure limitations and operational decline continue to restrict output. Therefore, while the Trump Venezuela oil deal unlocks access, it does not resolve capacity challenges.

Political pressure surrounding the Trump Venezuela oil deal

Meanwhile, events on the ground intensified political fallout. Venezuelan officials said dozens of security officers and civilians were killed during the U.S. operation. Officials described the strike as a war crime and announced investigations. Additionally, Cuba confirmed that 32 of its military and police personnel working in Venezuela were killed.

On the U.S. side, seven service members were injured, though five have returned to duty. As tensions rose, state-organized demonstrations briefly filled the streets of Caracas. Thus, the oil agreement unfolded amid visible instability rather than diplomatic calm.

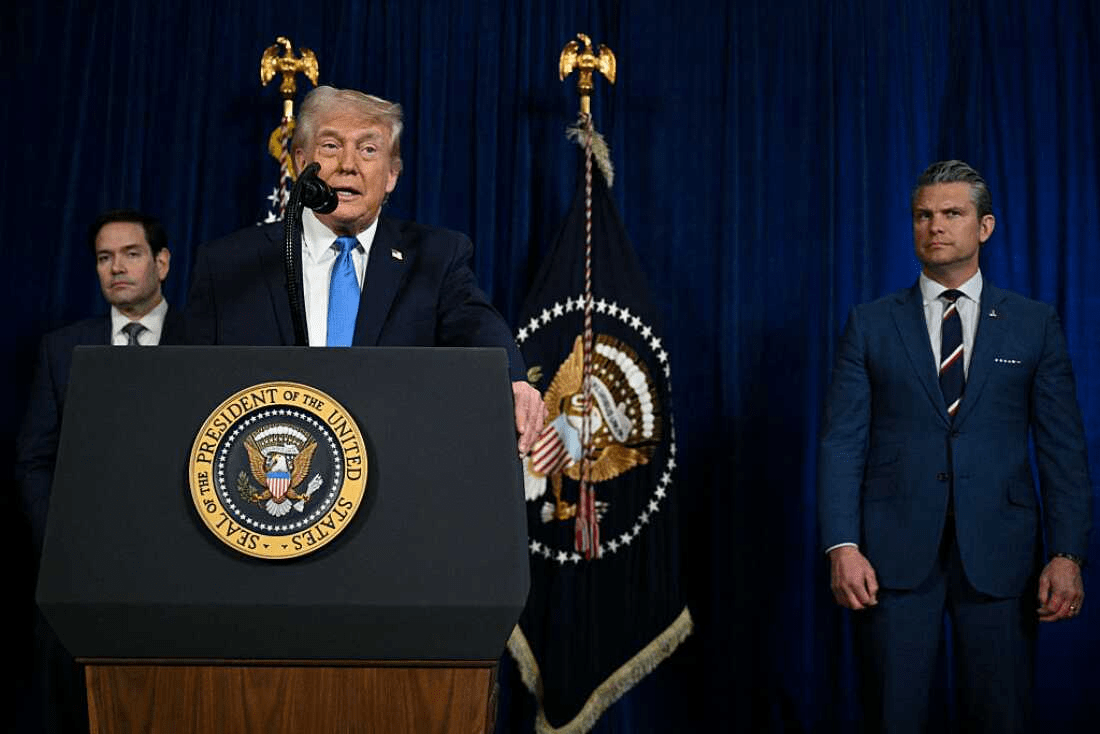

U.S. domestic reaction and leadership defense

Domestically, Trump pushed back against criticism from Democrats. He argued there was bipartisan agreement that Maduro was not Venezuela’s rightful president. Trump also noted that previous administrations had sought Maduro’s arrest on drug trafficking charges.

Maduro later pleaded not guilty in a U.S. courtroom. Still, public opinion remains divided. Polling showed Americans split on the military operation, with many still undecided. Importantly, most respondents said Venezuelans should determine their own leadership. Consequently, the Trump Venezuela oil deal exists alongside unresolved public consensus.

Regional and global implications beyond energy

Beyond Venezuela, regional reactions followed quickly. Colombia announced it would lodge a formal complaint over U.S. threats. At the same time, European leaders defended Greenland’s sovereignty after renewed U.S. rhetoric about territorial control.

Therefore, the Trump Venezuela oil deal appears as part of a broader foreign policy posture. Energy access, military action, and diplomatic pressure are increasingly intertwined. For businesses and investors, this raises execution risk alongside opportunity.

What the Trump Venezuela oil deal means for decision-makers

For energy companies, the situation presents both access and uncertainty. Market entry depends not only on reserves but also on political stability and operational safety. Likewise, governments must weigh short-term supply gains against longer-term geopolitical costs.

In this environment, leaders benefit from structured analysis that connects policy, energy, and risk management. Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category: https://uttkrist.com/explore/

How should global energy stakeholders evaluate short-term supply opportunities when political volatility remains unresolved?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore

https://qlango.com/