Chinese EV tariffs Canada cuts reshape North American market access

Canada’s decision to reduce import barriers marks a structural shift in North American electric vehicle trade. The move directly affects how Chinese automakers approach the region and how the United States positions itself in response. The policy change signals momentum for Chinese EVs edging closer to the U.S. market without crossing it directly.

The Chinese EV tariffs Canada cuts announcement lowers Canada’s import tax on Chinese electric vehicles from 100% to 6.1%. This single policy change alters cost structures, market entry strategies, and regional trade dynamics across North America.

How Chinese EV tariffs Canada cuts change market access dynamics

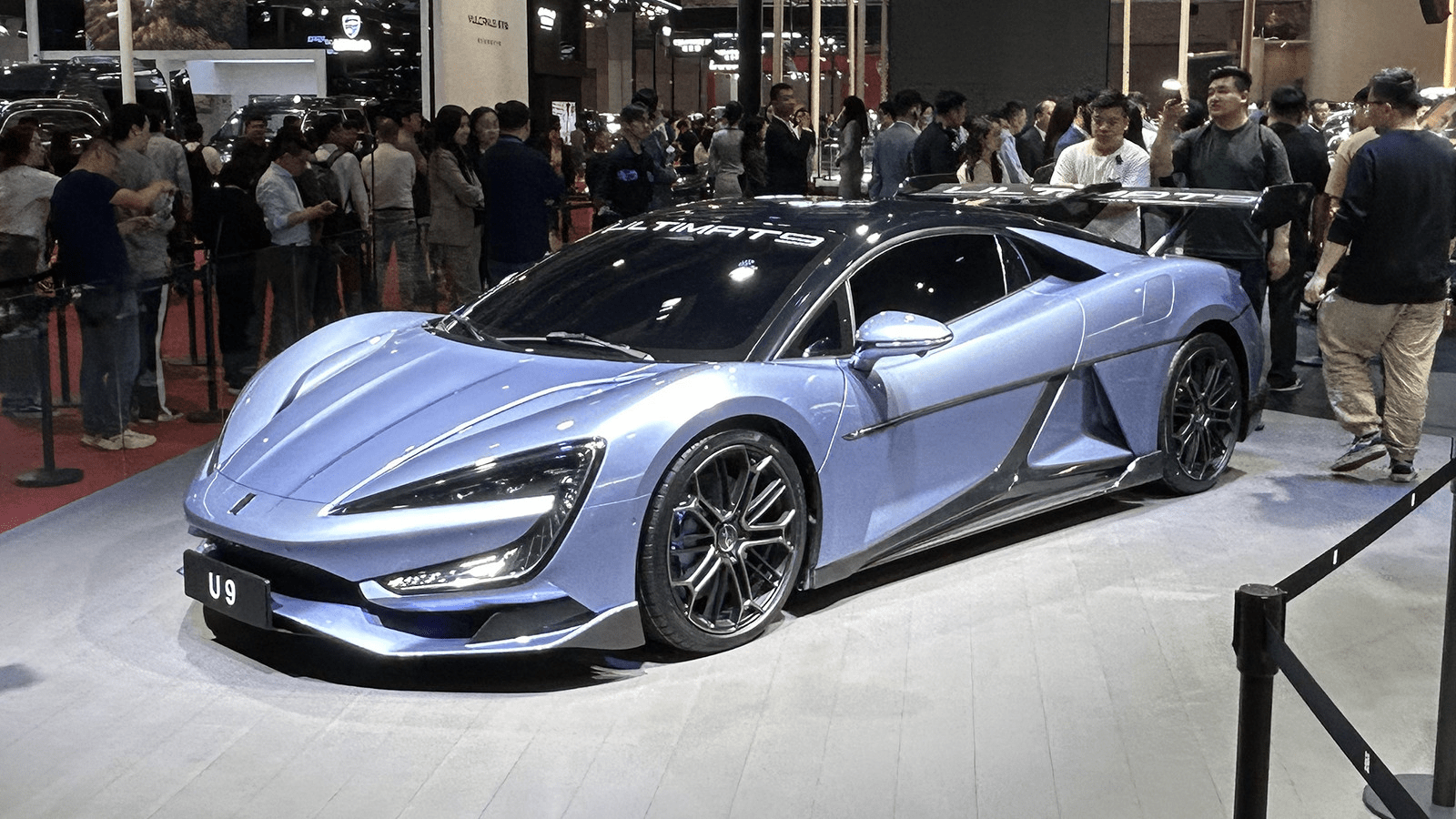

The tariff reduction allows Chinese automakers to establish a secondary North American entry point through Canada. Companies including Geely, BYD, and Xiaomi gain a viable path to sell vehicles at competitive prices. However, Canada is not fully opening the door.

Annual imports will be capped at 49,000 vehicles. That ceiling will rise gradually to roughly 70,000 units within five years. As a result, market access expands, but remains controlled.

This measured approach balances trade openness with domestic industry protection. It also positions Canada as a testing ground for Chinese EV demand in North America.

Why Chinese EV exports are accelerating now

China is actively increasing EV exports. This push coincides with discussions in the European Union about lowering tariffs on Chinese electric vehicles. Canada’s move aligns with this broader global trend.

At the same time, the United States continues to maintain a hard barrier. The 100% tariff on Chinese cars remains intact. As a result, direct entry into the U.S. market is economically unviable.

Nevertheless, Canada’s decision creates geographic proximity. That proximity matters for logistics, brand awareness, and regulatory learning.

The U.S. position as Chinese EVs move closer

While tariffs remain unchanged, the U.S. stance shows nuance. President Trump stated he would consider allowing Chinese automakers to build EV factories on U.S. soil. That statement contrasts with existing trade restrictions.

However, security and regulatory concerns persist. The U.S. has worked under both Presidents Biden and Trump to reduce dependence on China’s EV supply chain. National security remains a core issue.

Further, the Department of Commerce has restricted certain connected vehicles and related software linked to China or Russia. These rules add another layer of complexity beyond tariffs.

Price pressure and structural concerns for U.S. automakers

Chinese EVs sell at significantly lower prices than average U.S. vehicles. This pricing advantage stems from low capital costs, lower labor expenses, and aggressive market share strategies.

Industry leaders have acknowledged product quality improvements. Automotive journalists and executives, including Ford’s CEO, have publicly praised Chinese EVs.

Yet price competition is only part of the concern. U.S. policymakers also focus on supply chain exposure and defense industry implications.

Strategic implications for North American businesses

Canada’s tariff shift creates a new competitive landscape. Automakers, suppliers, and policymakers must reassess regional strategies. For businesses operating across borders, understanding regulatory divergence is now essential.

Companies navigating global trade, regulatory risk, and market expansion benefit from structured advisory support. Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category: https://uttkrist.com/explore/

As Chinese EVs advance through Canada rather than the U.S., strategic positioning becomes critical. Will Canada’s role as an entry point accelerate broader policy shifts across North America?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore