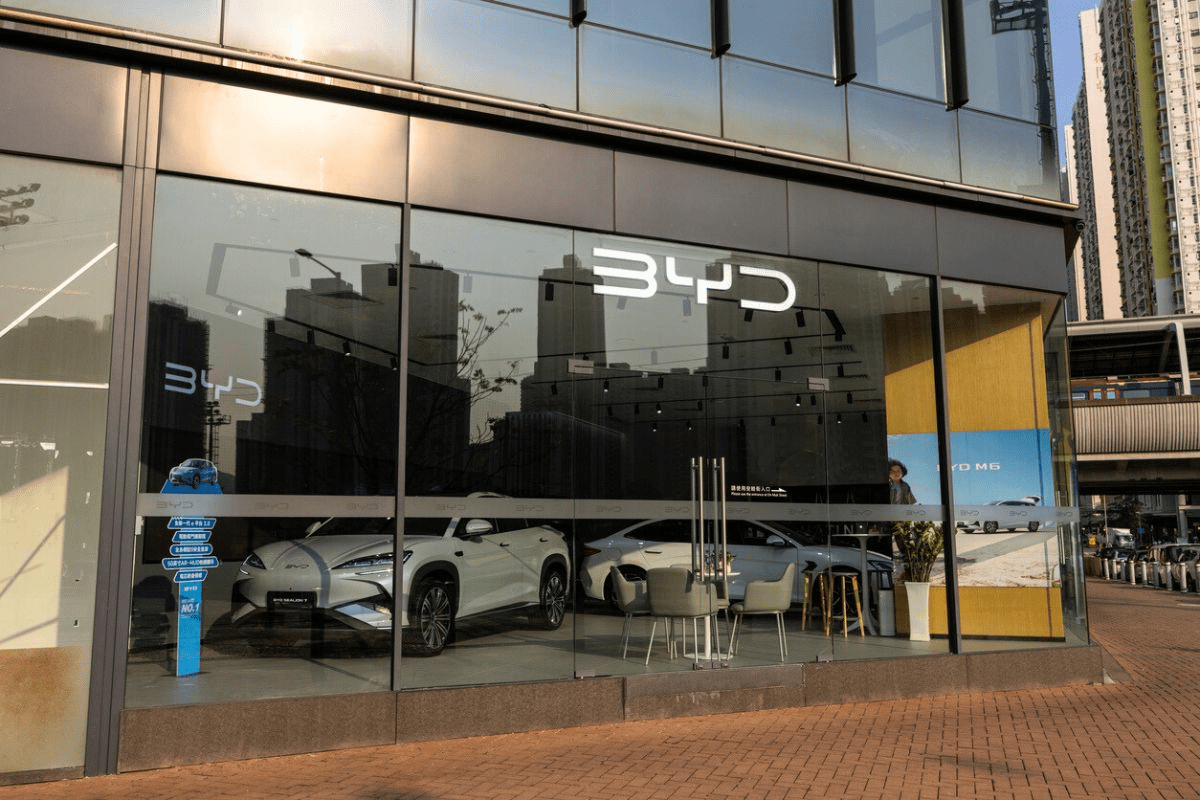

BYD sales growth slows as EV giant nears Tesla lead

China’s electric vehicle market is hitting a new phase. BYD sales growth slows after years of rapid expansion, yet the company remains on track to surpass Tesla in annual battery electric vehicle sales. The numbers show a market maturing fast. They also reveal how scale, competition, and policy shifts are reshaping the global EV race.

In 2025, BYD sold 4.6 million vehicles, up from 4.3 million in 2024. However, growth slowed sharply. Sales growth fell to 7.7%, the weakest pace in five years. Domestic competition and a saturated Chinese car market weighed on momentum. Even so, BYD delivered 2.3 million battery electric vehicles, a 27.9% increase year on year. That puts the company ahead of its closest rival.

This contrast defines the moment. Growth is slowing, but leadership is consolidating.

BYD sales growth slows amid China’s crowded EV market

China’s EV market has become intensely competitive. Carmakers are cutting prices to defend or gain share. Heavy investment has also created oversupply. As a result, even the largest players feel pressure.

December sales highlight this shift. BYD’s monthly sales dropped 18.3% year on year to about 420,000 vehicles, based on a January exchange filing. This decline underscores how demand volatility now affects even market leaders.

Yet scale still matters. Despite slower growth, BYD’s absolute volumes remain unmatched. The company’s ability to move millions of vehicles annually gives it resilience in a crowded market. Therefore, while BYD sales growth slows, its market position remains strong.

For executives tracking global EV dynamics, this is a signal. The era of effortless growth is ending. Execution now matters more than expansion.

BYD versus Tesla sales outlook shows diverging pressures

While BYD pushes volume, Tesla faces a different set of challenges. Analyst estimates shared in late December suggest Tesla sold about 1.6 million battery electric vehicles in 2025. Future projections point to 1.8 million in 2026, 2 million in 2027, and 3 million in 2029. These figures fall below earlier claims of far higher sales by 2027.

Tesla’s sales struggled during the year. Consumer distaste linked to CEO Elon Musk’s involvement in U.S. politics weighed on demand. In addition, the rollback of electric vehicle subsidies under the Trump administration is expected to slow U.S. sales further.

Operationally, Tesla delivered 1.2 million vehicles in the first three quarters of 2025. Fourth-quarter numbers are expected in early January. Meanwhile, markets reacted differently. BYD shares rose 3.6% in Hong Kong trading after the update, while Tesla shares gained 18.6% over the year, outperforming BYD’s stock.

The takeaway is clear. Tesla faces demand and policy headwinds. BYD faces saturation and competition. Both are navigating pressure, but from opposite sides.

Overseas expansion becomes critical as domestic growth cools

As domestic competition intensifies, Chinese automakers are looking outward. China is now the world’s largest car exporter, surpassing traditional manufacturing leaders like Japan and Germany. BYD sits at the center of this shift.

The company leads EV sales across Southeast Asia. It dominates markets such as Thailand and Malaysia. In Singapore, BYD overtook Toyota to become the top-selling car brand in 2025. These wins show how Chinese EV brands are gaining trust beyond their home market.

Europe is next. BYD has established its first European factory in Szeged, Hungary. Production is set to begin in 2026, with capacity for about 150,000 compact all-electric sedans annually. At the same time, BYD is building or planning facilities in Thailand, Indonesia, and Brazil.

This expansion strategy offsets domestic slowdown. It also signals a long-term commitment to global manufacturing footprints. When BYD sales growth slows at home, international markets become the growth engine.

Strategic signals for global EV leaders and investors

Several signals emerge from these developments. First, scale no longer guarantees growth. Even the largest EV manufacturers must adapt to saturation and pricing pressure. Second, policy remains decisive. Subsidy changes and political factors can quickly alter demand trajectories. Third, overseas expansion is no longer optional. It is essential.

For business leaders and investors, this moment requires sharper analysis. Understanding where growth slows, where it shifts, and why it changes is now a strategic necessity. Platforms that enable structured insight and global perspective can help organizations navigate these transitions. In this context, decision-makers often explore broader business intelligence and advisory capabilities through resources like https://uttkrist.com/explore/ to assess market shifts with clarity.

As EV competition intensifies across regions, the winners will be those who combine scale with adaptability. They will also rely on learning and capability-building tools, including global language and workforce solutions such as https://qlango.com/, to support international expansion.

With growth slowing at home but momentum building abroad, how will global EV leaders balance scale, policy risk, and market diversification in the next phase of competition?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore