China Lidar Production Surge Signals Global Industry Shakeout

China lidar production surge is reshaping the global sensor market at a decisive moment. Hesai has announced plans to double its annual production capacity, increasing output from 2 million units to 4 million units within a year. This move follows a period of rapid change in the lidar industry, marked by consolidation, bankruptcies, and shifting demand patterns across automotive and robotics sectors.

The announcement highlights how scale, cost pressure, and regional adoption trends are redefining competitive advantage. As legacy players struggle to sustain operations, production expansion has become a strategic signal of confidence and market control.

China Lidar Production Surge and Market Timing

The China lidar production surge comes shortly after a major U.S. lidar manufacturer filed for Chapter 11 bankruptcy. That company is not expected to continue operating once its restructuring plan is approved, though it is exploring a sale of its lidar business.

Against this backdrop, Hesai’s capacity expansion reflects a clear attempt to capture global market share during a period of industry shakeout. The company reported that it surpassed one million units shipped in 2025 and now plans to quadruple that scale compared with earlier years.

This timing matters. As weaker competitors exit, remaining suppliers with scale can dictate pricing, delivery timelines, and long-term contracts.

Automotive Demand Driving Lidar Expansion

Automotive adoption remains central to the China lidar production surge. Hesai stated that lidar sensors are now used in 25% of new electric vehicles sold in China. Moreover, many upcoming vehicle models are expected to integrate between three and six lidar sensors per car.

This trend significantly expands the total addressable market. Hesai reported having 24 automotive customers, including one described as a top European automaker. It also disclosed four million orders for its latest ATX lidar sensor.

Outside China, automotive lidar demand has been less predictable. Delays, cost overruns, and cancelled vehicle programs contributed to the collapse of earlier integration plans by Western manufacturers.

Robotics as the Next Growth Frontier

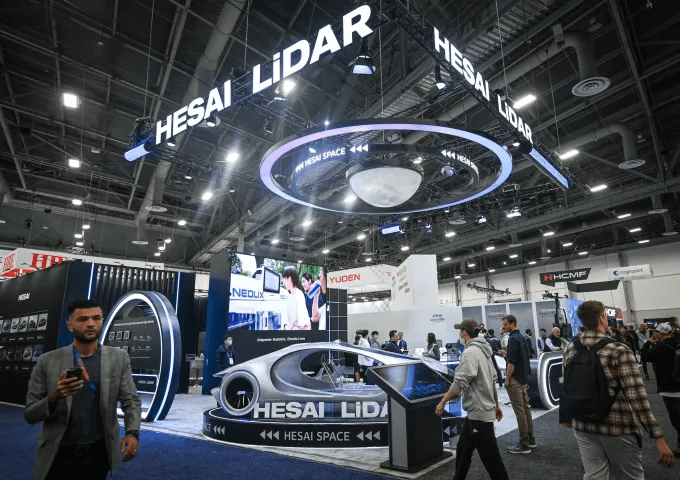

Robotics has emerged as another pillar supporting the China lidar production surge. At CES 2026, Hesai showcased lidar-enabled products such as a robotic lawnmower and a robotic dog using its JT series sensor. The company also hinted at future inclusion in humanoid robots.

Hesai has secured deals with autonomous vehicle developers, supplying sensors to companies working on self-driving technologies. While robotics remains an uncertain market, several industry players see substantial long-term potential across delivery robots, industrial automation, and defense-related applications.

This diversification reduces reliance on a single sector and helps stabilize demand during automotive market fluctuations.

Cost Compression and Competitive Pressure

One of the most disruptive elements of the China lidar production surge is cost reduction. Hesai claimed it has driven down lidar sensor costs by 99.5% over eight years. This pricing pressure has been cited as a key factor in the financial collapse of competitors based outside China.

Lower prices have accelerated adoption but also compressed margins across the industry. Companies unable to match cost efficiencies have struggled to reach sustainable scale.

In this environment, production capacity is not just operational—it is strategic leverage.

Strategic Implications for Global Technology Markets

The China lidar production surge underscores a broader pattern in advanced hardware markets. Scale, domestic adoption, and aggressive cost control can outweigh early technological leadership. As consolidation continues, buyers may face fewer suppliers but more standardized offerings.

For businesses navigating this shift, understanding supplier resilience and market structure is critical. Many organizations increasingly rely on advisory platforms to evaluate technology exposure and supply chain risk. Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category: https://uttkrist.com/explore/

As lidar becomes embedded across vehicles and robots, strategic sourcing decisions will shape competitiveness for years.

Looking Ahead

The China lidar production surge is not just about volume. It reflects a decisive phase where market winners emerge through scale, pricing power, and diversified demand. As weaker players exit, the remaining suppliers will influence how quickly and widely lidar technology spreads.

What does this consolidation mean for innovation and supplier dependence in the next generation of autonomous systems?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore

https://qlango.com/