CoreWeave AI Supply Chain Faces a Violent Shift

The CoreWeave AI supply chain debate reframes AI growth as a physical infrastructure crisis, not a circular financial loop.

Rethinking the CoreWeave AI Supply Chain Narrative

The CoreWeave AI supply chain sits at the center of today’s artificial intelligence expansion.

Yet, critics often frame this growth as a circular economy. In that view, money flows between chipmakers, cloud firms, and AI companies without creating real value.

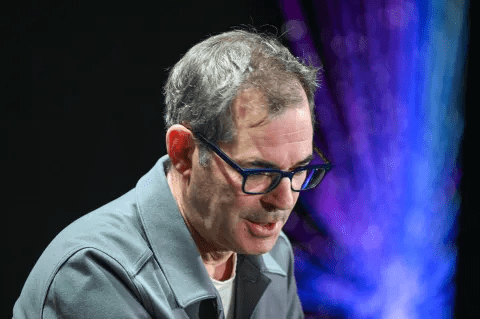

At a recent industry gathering in San Francisco, CoreWeave CEO Michael Intrator rejected that interpretation.

He described the current environment as a violent shift in supply and demand.

According to him, the issue is not financial engineering.

It is a physical imbalance reshaping global infrastructure.

Why Collaboration Defines the AI Supply Chain

Observers often highlight investment loops within the AI sector.

Chipmakers fund infrastructure firms. Those firms then purchase chips.

From the outside, the model looks self-referential.

From the inside, Intrator sees necessity.

The CoreWeave AI supply chain relies on deep collaboration because no single company can resolve today’s constraints alone.

Supply volatility forces coordination across vendors, customers, and infrastructure providers.

In short, cooperation has become the operating system of AI growth.

Physical Bottlenecks Drive the CoreWeave AI Supply Chain

Intrator identified the primary constraint facing AI as physical.

Capital and policy are secondary concerns.

The real challenge is delivering high-performance compute to the most advanced users.

That compute remains scarce.

Data centers, hardware availability, and deployment timelines now dictate pace.

As a result, the CoreWeave AI supply chain reflects logistics, not leverage.

Infrastructure Pressures Reach Deep into Materials

The supply challenge does not stop at servers or racks.

It extends into raw materials.

Intrator shared insights from a recent discussion with a mining executive.

The executive described how AI demand now affects production two levels deeper in the supply chain.

Copper and essential metals have become pressure points.

Meeting demand requires coordination across industries.

For mining leaders, collaboration sounds practical.

For AI leaders, the same message draws criticism.

Market Risks and Secondary GPU Concerns

Some critics warn of potential downside scenarios.

If an infrastructure firm fails to refinance debt or loses a major customer, lenders could sell used GPUs into secondary markets.

That outcome could depress hardware prices.

It could also ripple across the AI ecosystem.

Intrator acknowledged the concern.

However, he emphasized that demand escalation remains the dominant force shaping the CoreWeave AI supply chain.

CoreWeave’s Position Amid Relentless Demand

CoreWeave focuses on parallelized computing.

This capability has placed the company at the center of AI infrastructure expansion.

Intrator described demand from large technology companies as relentless.

These buyers, he noted, are sophisticated and highly informed.

For him, this demand signal outweighs speculative narratives.

It validates the structural shift toward parallel compute at scale.

Stock Volatility Reflects Structural Disruption

Since its IPO, CoreWeave’s stock has fluctuated sharply.

Intrator attributed this movement to market adjustment.

The company challenges traditional cloud dominance.

That disruption introduces uncertainty for investors.

Despite volatility, the stock has traded significantly above its IPO price.

Intrator framed this as evidence of long-term confidence within the CoreWeave AI supply chain story.

Reducing Customer Concentration Exposure

Customer concentration has also drawn attention.

At one point, a single customer represented a large share of revenue.

Intrator acknowledged that risk.

He stated that diversification efforts have reduced reliance on any one client.

Today, no single customer accounts for more than 30% of backlog.

This shift strengthens resilience across the CoreWeave AI supply chain.

Viewing AI Infrastructure as a Super-Cycle

Intrator urged investors to look beyond short-term noise.

Minor execution delays often trigger outsized reactions.

He described the current moment as a macro super-cycle.

The transition from sequential to parallelized computing is foundational.

This shift unlocks compute capacity at unprecedented scale.

Temporary disruptions pale in comparison.

Policy, Energy, and the Limits of Speed

Delivering AI compute remains constrained by more than hardware.

Policy, physical infrastructure, and energy availability all impose limits.

No single firm can solve these challenges alone.

Industry-wide cooperation becomes the only viable path.

According to Intrator, this reality defines the CoreWeave AI supply chain.

What appears circular is, in practice, adaptive coordination.

Strategic Implications for Business Leaders

AI growth is no longer a software-only story.

It is an infrastructure and supply chain story.

Executives evaluating AI exposure must account for materials, energy, and logistics.

Ignoring these factors leads to incomplete risk assessments.

For organizations navigating similar complexity, enabling partners matter.

Explore the services of Uttkrist, our services are global in nature and highly enabling for businesses of all types, drop us an inquiry in your suitable category: https://uttkrist.com/explore

Looking Ahead

The AI boom continues to accelerate.

As it does, supply constraints will intensify.

The CoreWeave AI supply chain highlights a broader truth.

Progress now depends on cooperation as much as innovation.

If AI growth is constrained by physical reality, how should leaders rethink scale, risk, and long-term strategy?

Explore Business Solutions from Uttkrist and our Partners’, Pipedrive CRM [2X the usual trial with no CC and no commitments] and more uttkrist.com/explore