Google co-founders leaving California amid billionaire tax measure signals

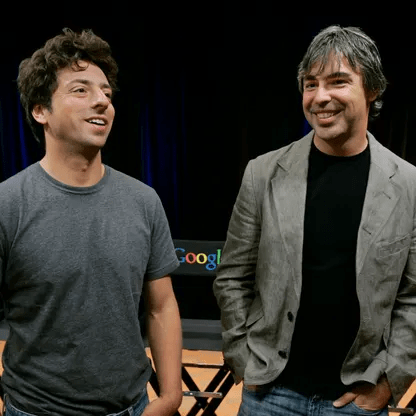

Sergey Brin and Larry Page appear to be reducing their presence in California. The shift has gained attention because it aligns with a proposed state-level billionaire tax. The situation highlights how policy signals can influence decisions by some of the world’s wealthiest technology founders.

Reports indicate that in December, 15 limited liability companies overseeing Brin’s investments and interests were terminated or converted into Nevada entities. These include entities connected to one of his superyachts and his interest in a private terminal at San Jose International Airport. Around the same time, 45 LLCs associated with Page reportedly became inactive or moved out of state. In addition, a trust linked to Page purchased a $71.9 million mansion in Miami.

These developments point toward strategic repositioning rather than a simple relocation. For ultra-wealthy individuals, residency and asset management are rarely binary decisions. Instead, they involve layered legal, financial, and geographic considerations.

Proposed billionaire tax and its retroactive implications

The reported activity coincides with a prospective California ballot measure. The proposal would impose a one-time 5% tax on individuals worth more than $1 billion. If it reaches the ballot and passes, the tax would apply retroactively to anyone who lived in California as of January 1 of this year.

This retroactive element significantly raises the stakes. For individuals with complex holdings, exposure could be substantial. As a result, restructuring corporate entities and shifting legal footprints becomes a rational response to policy uncertainty. The reported actions by Brin and Page illustrate how quickly financial structures can be adjusted when regulatory outcomes remain unclear.

At the same time, the situation is not black and white. Both founders are said to still own homes in California. This suggests caution rather than a full exit, reinforcing the idea that wealth mobility often moves faster on paper than in personal life.

California policy signals and founder risk management

California has long been a hub for technology founders and global capital. However, policy direction plays a decisive role in shaping long-term commitments. The moves associated with Brin and Page suggest a focus on risk management rather than ideology.

For executives and investors, the broader lesson is clear. Regulatory changes can alter financial exposure overnight. Strategic planning increasingly requires jurisdictional flexibility, legal foresight, and asset-level agility. Decisions at this scale are less about relocation and more about optionality.

In this environment, businesses often look for structured guidance to navigate regulatory and cross-border complexity. Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category:

https://uttkrist.com/explore/

Wealth mobility and the future of state taxation

The reported actions of two prominent founders may influence sentiment among other billionaires. If the ballot measure progresses, similar strategies could follow. This dynamic creates a tension between revenue ambitions and taxpayer behavior.

California’s innovation ecosystem remains influential, yet policy design will shape how founders balance roots with risk. The current situation underscores a broader question facing governments and business leaders alike: how to pursue fiscal objectives without accelerating capital and residency shifts.

As states compete for talent, investment, and long-term commitment, how will policymakers adapt to ensure that taxation strategies do not unintentionally drive the very wealth they seek to capture?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore/