Intel’s $8.9 Billion Government Stake Deal Tests CHIPS Act Limits

Intel Secures $8.9 Billion Investment Through Grant Conversion

The U.S. government has officially acquired a 10% stake in Intel, marking a significant intervention in the semiconductor sector. Valued at $8.9 billion, the transaction does not involve fresh federal funding. Instead, it converts previously awarded but unpaid grants from the CHIPS and Science Act and Secure Enclave program into equity.

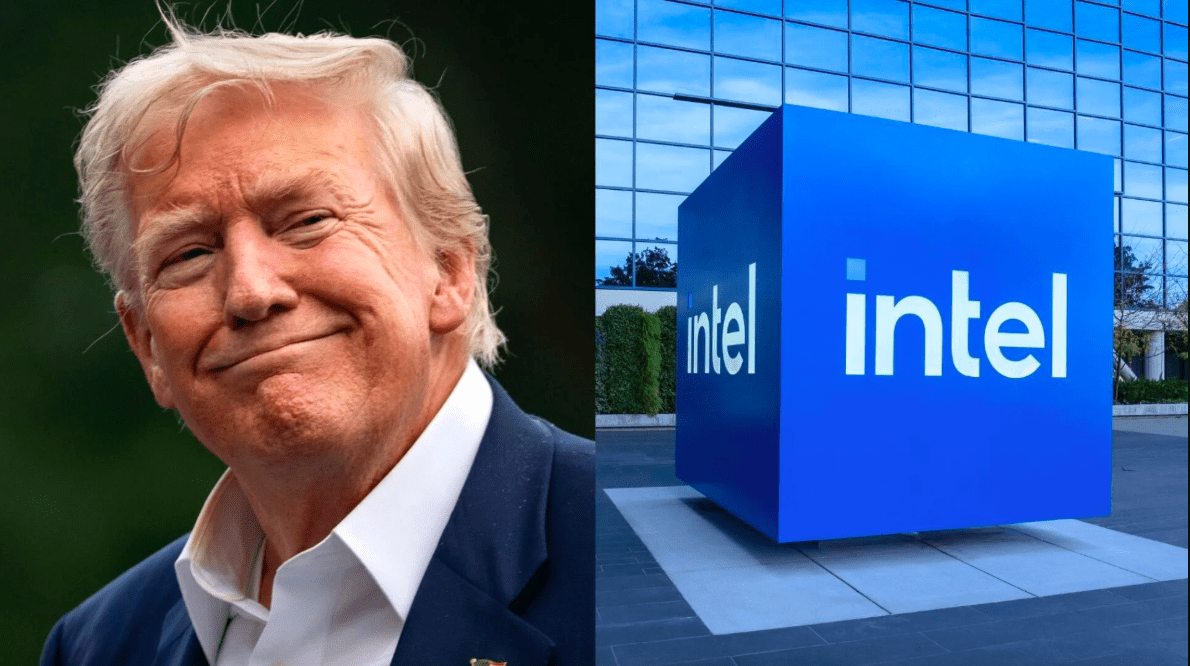

The arrangement, announced by Intel and President Donald Trump, comes at a time when the chipmaker faces mounting competitive pressures from industry leaders like Nvidia and AMD. Intel aims to use the financial infusion to support its foundry operations and reinforce its role in the U.S. semiconductor supply chain.

CHIPS Act at the Center of Debate in Intel $8.9 billion government stake deal

The CHIPS and Science Act, introduced to strengthen domestic semiconductor production, has been a focal point of U.S. industrial policy. However, this deal highlights potential ambiguities within the legislation. Legal experts have raised questions about whether the Act permits grants to be converted into equity stakes.

In June, Intel disclosed that it had received $2.2 billion in CHIPS Act funding but was awaiting an additional $850 million in reimbursement. The newly announced arrangement not only delivers pending funds but also positions the government as one of Intel’s largest shareholders, triggering a closer look at the Act’s compliance framework.

Trump’s Policy Shift on Semiconductor Funding

President Donald Trump has been an outspoken critic of the CHIPS Act, calling it a “horrible, horrible thing” and urging congressional leaders to eliminate it. Yet, the latest agreement underscores a pragmatic shift in policy.

On his social media platform, Trump emphasized that “The United States paid nothing for these shares,” framing the deal as a strategic move to strengthen U.S. manufacturing while protecting taxpayer interests. Market response was immediate, with Intel’s stock rallying more than 5% following the announcement.

CEO Lip-Bu Tan Gains Presidential Backing

The agreement also signals a notable change in Trump’s stance toward Intel CEO Lip-Bu Tan. Earlier this month, Trump had called for Tan’s resignation, citing potential conflicts of interest linked to prior investments. Following a meeting between the two, Trump publicly praised Tan as a “Highly Respected Chief Executive Officer” who successfully negotiated the deal.

For Intel, leadership stability is critical as it navigates financial restructuring, regulatory challenges, and intense competition. Tan expressed gratitude for the administration’s support, highlighting the company’s commitment to advancing U.S. technology leadership.

Governance and Strategic Implications

The government’s newly acquired stake will remain passive in Intel $8.9 billion government stake deal, with no board seats or governance rights. However, the deal includes a five-year warrant allowing the government to purchase an additional 5% of Intel’s common stock if the company sells more than 49% of its foundry business.

This provision underscores Washington’s interest in maintaining influence over critical manufacturing capabilities without exerting direct control. While investors have reacted positively to the announcement, legal scrutiny could introduce uncertainty in the months ahead.

Market Context and Competitive Pressures

Despite the capital infusion, Intel continues to face structural challenges in an intensely competitive semiconductor market. Rivals such as Nvidia and AMD have secured dominant positions in high-performance computing and AI-focused chip segments, areas where Intel has struggled to regain ground.

Analysts caution that financial support alone may not resolve these core issues. Success will depend on Intel’s ability to accelerate innovation, expand its foundry business, and restore profitability after a reported $18.8 billion loss in 2024.

Potential Legal Challenges

The legality of the grant-to-equity conversion remains an open question. Some legal experts argue that the CHIPS Act does not explicitly authorize such conversions, potentially exposing the deal to court challenges. The outcome of these assessments could shape future federal interventions in private-sector technology firms.

If upheld, the deal could serve as a blueprint for similar agreements across the semiconductor industry, reinforcing the government’s role in securing critical supply chains. If overturned, it may require congressional revisions to industrial policy frameworks.

Reflective Question

Can Intel leverage this $8.9 billion deal to regain technological leadership, or will deeper operational reforms determine its future in the semiconductor race?

Explore Business Solutions from Uttkrist and our Partners’, Pipedrive CRM [2X the usual trial with no CC and no commitments] and more uttkrist.com/explore