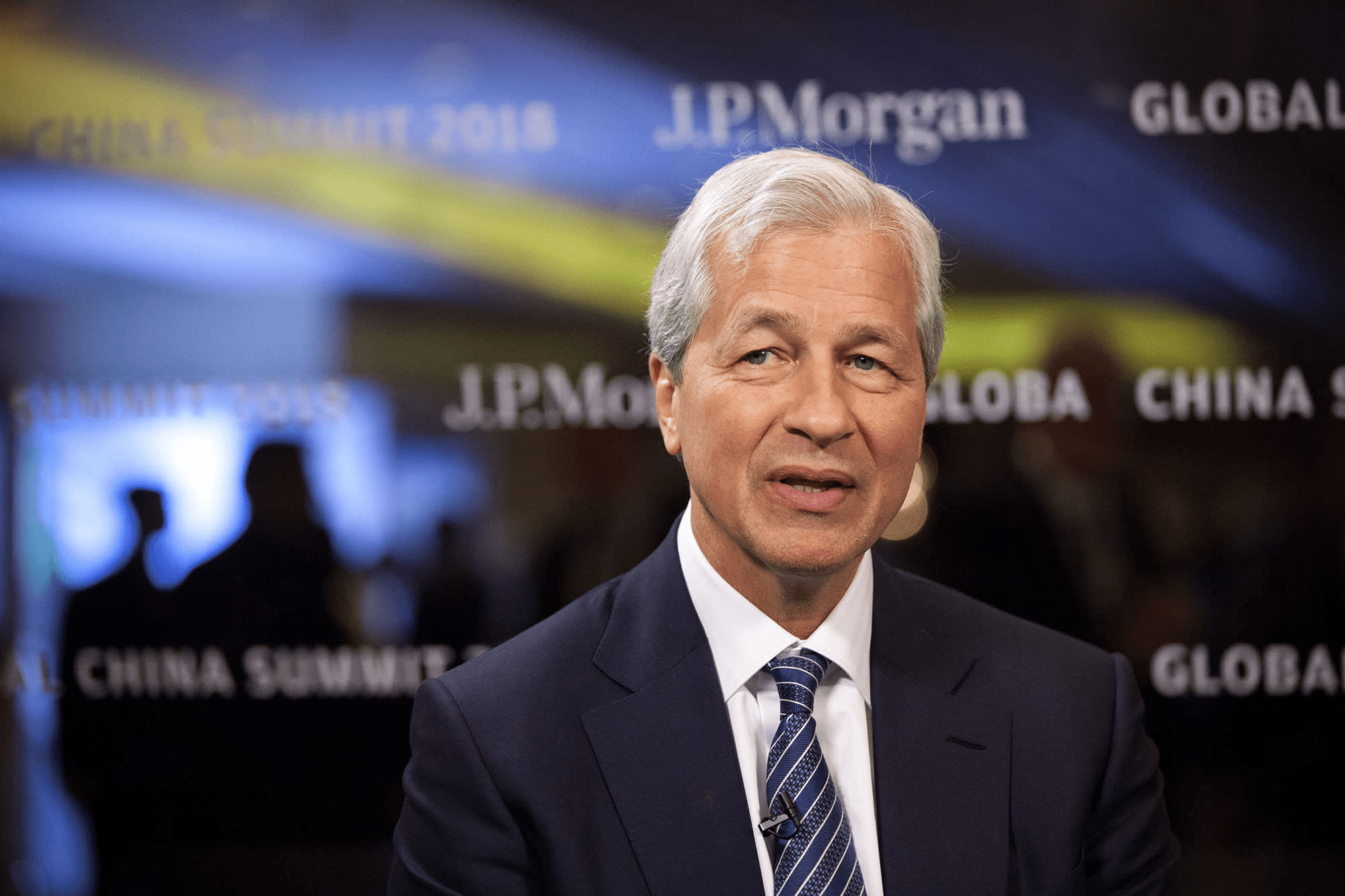

Jamie Dimon compensation 2025 shows how JPMorgan stock gains reshaped executive pay

The story of Jamie Dimon compensation 2025 is not about a single bonus. It reflects how equity, dividends, and long-term leadership combine during a market rebound. After a volatile period, large banks saw stock growth approach 30%. As a result, executive pay followed the same direction.

Jamie Dimon has spent two decades leading JPMorgan. During that time, he rarely sold shares. That decision shaped the outcome in 2025. He entered the year holding about 7.3 million shares. At the starting share price, his stake was valued near $1.8 billion. By year-end, the share price had climbed sharply, lifting that value to roughly $2.4 billion.

This shift explains why Jamie Dimon compensation 2025 stands out. It was driven less by annual salary changes and more by long-term equity exposure.

How long-term equity shaped Jamie Dimon compensation 2025

Dimon’s approach to ownership matters here. Over many years, he accumulated equity through compensation plans, personal purchases, and a special one-time award granted in 2021. That award was designed to retain him while succession planning was underway.

In 2025, stock appreciation alone added more than $600 million in value. Dividends contributed another $40 million. On top of that, a special stock award began vesting, adding further upside. Together, these elements pushed total gains for the year to about $770 million.

This structure shows why Jamie Dimon compensation 2025 cannot be viewed as a single paycheck. Instead, it reflects how boards reward tenure, continuity, and alignment with shareholders. When stock prices rise, executives with deep equity exposure benefit alongside investors.

Organizations navigating similar leadership questions often examine these compensation mechanics closely. Many turn to advisory ecosystems like https://uttkrist.com/explore/ to understand how governance, incentives, and performance alignment can be structured across markets.

What bank-wide pay trends reveal beyond one CEO

The broader context matters. Compensation growth was not limited to one corner office. Across financial services, pay increases exceeded expectations in 2025. Depending on role and segment, increases ranged from mid-single digits to as high as 25%.

Several factors supported this rebound. Early fears around tariffs eased. Some measures were reduced or reversed. Meanwhile, the second half of the year brought stronger trading activity, increased mergers, and new market highs. Together, these trends restored confidence across traditional banking.

Within this environment, Jamie Dimon compensation 2025 became a high-profile example of how legacy banks “roared back.” It also highlighted how compensation systems amplify market momentum rather than operate independently from it.

For leaders and investors, this reinforces a key lesson. Executive pay outcomes are often lagging indicators of strategy, stability, and timing. Advisory platforms such as https://uttkrist.com/explore/ exist to help businesses interpret these signals and apply them thoughtfully.

AI, headcount pressure, and the next compensation challenge

Despite the strong year, challenges remain. Financial services headcount has grown significantly since the last crisis. However, expectations are shifting. Over the next three to five years, workforce levels could decline as AI reshapes operations.

This creates tension within established career ladders. If fewer entry-level roles exist, the pipeline for future leaders changes. Traditional hierarchies, built over decades, may no longer function as designed. While Jamie Dimon compensation 2025 reflects success under the current model, future frameworks may look very different.

Boards and executives are already grappling with these questions. How do firms develop talent when fewer people enter at the base? How does compensation evolve when productivity increases but headcount falls? No clear answer has emerged yet.

Strategic clarity in moments like this often comes from structured exploration. Many organizations begin that process through platforms such as https://uttkrist.com/explore/, where global, category-specific support helps leaders think through complex transitions.

As executive pay, AI adoption, and workforce design continue to intersect, what signals should leaders prioritize when defining the next generation of compensation models?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore

https://qlango.com/