Powell Investigation Fed Independence Sends Markets Reeling

U.S. equity futures slid sharply after confirmation of an investigation involving Federal Reserve Chair Jerome Powell.

The issue immediately shook market confidence and revived fears about political pressure on monetary policy.

The reaction was swift.

Equity futures fell across major indexes, led by technology-heavy contracts.

At the same time, investors rushed toward assets traditionally seen as protection during uncertainty.

This moment matters because markets price credibility.

Any signal that challenges central bank independence quickly ripples through equities, currencies, and commodities.

Markets React as Powell Investigation Raises Fed Independence Fears

Futures tied to the Nasdaq 100 dropped the most, reflecting sensitivity to interest-rate expectations.

S&P 500 and Dow Jones futures also moved lower, though by smaller margins.

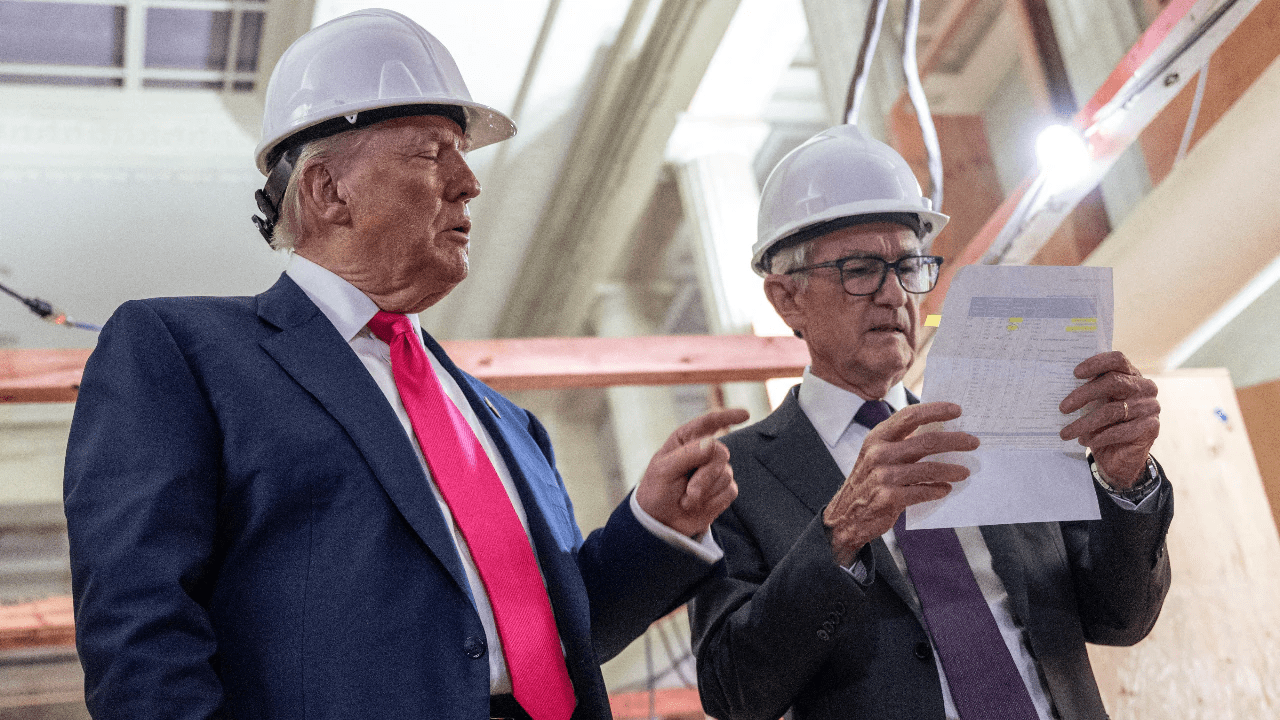

This selling pressure followed confirmation that Powell is under investigation related to prior testimony on Federal Reserve building renovations.

The disclosure unsettled investors already wary of political interference.

Concerns resurfaced around whether monetary policy decisions can remain insulated from executive influence.

Safe-Haven Assets Surge Amid Political and Monetary Uncertainty

As equities fell, capital rotated fast.

Gold futures climbed sharply.

Silver posted even stronger gains.

The U.S. dollar weakened modestly against major currencies.

Investors favored the Swiss franc and Japanese yen during the risk-off move.

This pattern reflects a familiar playbook.

When institutional trust erodes, liquidity seeks perceived stability.

Powell’s Statement Signals a Rare Institutional Breaking Point

After years of restraint, Powell issued a pointed public statement.

He acknowledged accountability under the law.

However, he framed the investigation within broader political pressure on the Federal Reserve.

Powell stated that the threat was not truly about testimony or renovations.

Instead, he argued it stemmed from interest-rate decisions made independently of presidential preference.

This framing elevated the debate from procedural questions to structural concerns.

Economists Warn of Long-Term Inflation and Market Damage

Economists cautioned that executive influence over the Fed could trigger lasting consequences.

One concern is a self-fulfilling cycle of higher long-term inflation.

Another risk involves borrowing costs.

Even perceived cracks in independence can spread rapidly across markets.

Past warnings from major financial institutions highlighted similar dangers.

They pointed to potential disruptions in bond and currency markets if independence weakens.

Why Fed Independence Remains a Market Cornerstone

Central bank independence anchors expectations.

It underpins currency credibility, bond pricing, and equity valuation.

When that anchor appears threatened, markets respond defensively.

Executives and investors understand that stability relies on institutional distance from politics.

For leaders navigating macro risk, structured perspective matters.

Many evaluate policy and market shifts through platforms like https://uttkrist.com/explore/, where globally oriented services support informed decision-making.

What Comes Next for Markets and Policy Credibility

The investigation’s outcome remains uncertain.

However, the market response already reveals underlying sensitivity.

Trust, once questioned, takes time to rebuild.

Executives, investors, and policymakers will watch closely for signals of institutional resilience.

What does sustained pressure on central bank autonomy mean for long-term economic stability?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore/