Tech Billionaires Cashed Out $16 Billion in 2025 as Stocks Soared

Insider stock sales surged as executives converted record valuations into cash

Tech billionaires cashed out $16 billion in 2025 as stocks soared, marking a defining moment in how top executives responded to historic market conditions. While technology stocks reached record highs throughout the year, company leaders moved decisively to turn paper wealth into realized gains. According to insider trading data analysis, these transactions were not isolated events but part of a broader, coordinated pattern across the technology sector.

This wave of selling unfolded alongside a sustained rally in technology equities. Executives acted while valuations remained elevated, signaling confidence in timing rather than concern about fundamentals. Importantly, the scale of these transactions highlights how liquidity events now play a central role in executive financial strategy during prolonged market upswings.

The cumulative value of these sales exceeded $16 billion, underscoring how significantly insiders participated in the rally’s upside.

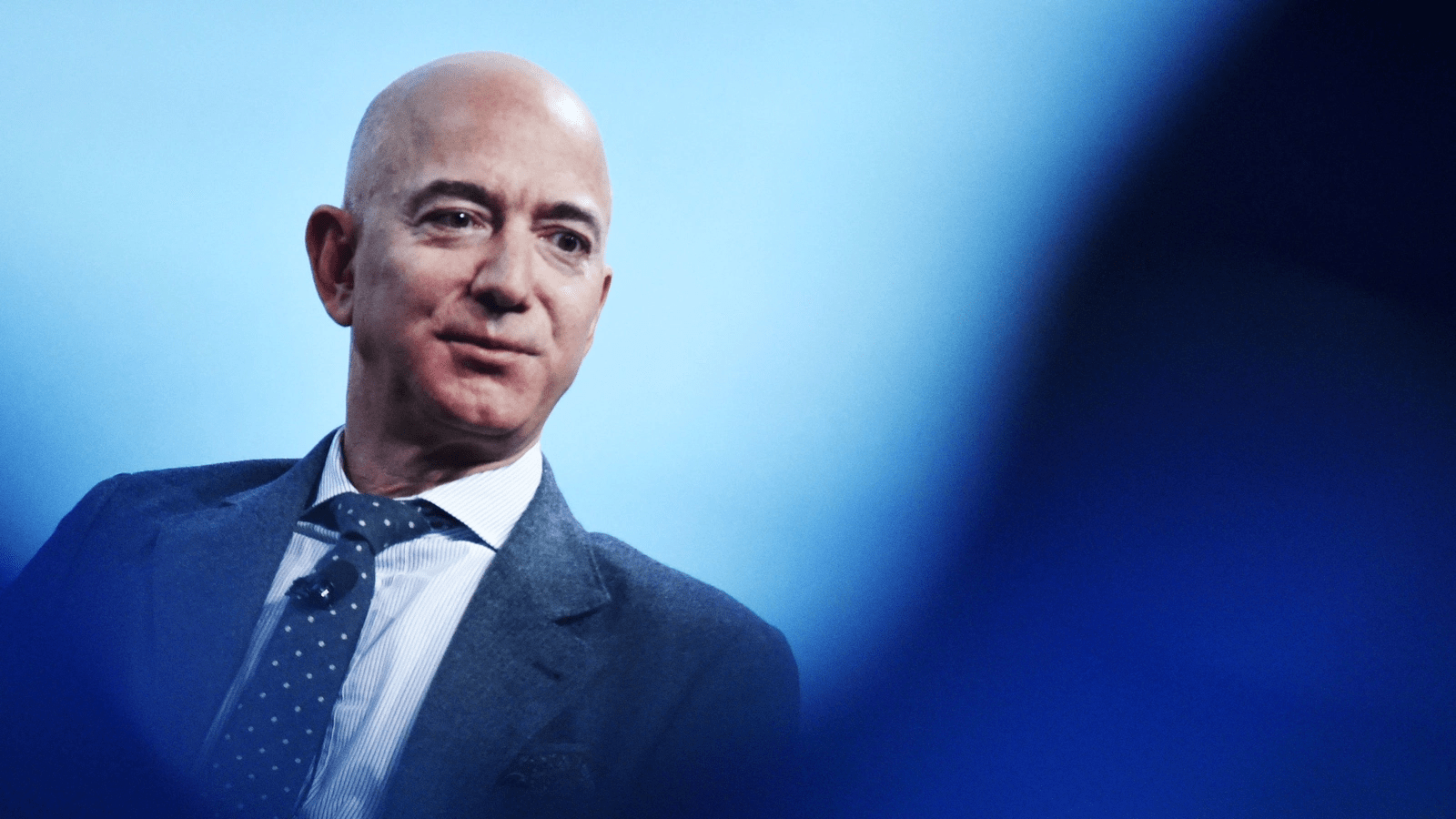

Jeff Bezos led executive stock sales during the 2025 rally

Among those who moved most aggressively, Jeff Bezos stood out. The Amazon founder sold 25 million shares worth $5.7 billion during June and July. These sales placed him at the top of the list of executives monetizing equity in 2025. The timing coincided with peak market strength, reinforcing the disciplined nature of the decision.

Other senior leaders followed closely. Oracle’s former CEO Safra Catz sold $2.5 billion in stock. Michael Dell converted $2.2 billion of his holdings into cash. Each transaction reflected deliberate execution rather than reactive selling.

These sales were not driven by sudden shifts in company outlooks. Instead, they aligned with a year defined by rising stock prices and strong investor sentiment. Tech billionaires cashed out $16 billion in 2025 as stocks soared, and leadership-level participation made that trend unmistakable.

AI-driven momentum shaped executive decisions in 2025

Artificial intelligence played a central role in sustaining the rally. The market’s upward momentum was fueled by expectations around AI adoption, infrastructure demand, and long-term revenue growth. Nvidia became the world’s first $5 trillion company during this period, reinforcing investor confidence across the sector.

Nvidia CEO Jensen Huang sold $1 billion in shares while the company’s valuation surged. Arista Networks CEO Jayshree Ullal also sold nearly $1 billion as demand for high-speed networking equipment increased. Her net worth crossed $6 billion during the year, reflecting how AI-related demand reshaped executive wealth.

This environment created optimal conditions for insiders to act. Tech billionaires cashed out $16 billion in 2025 as stocks soared largely because AI-driven optimism continued pushing prices higher throughout the year.

Pre-arranged trading plans defined the selling pattern

A key feature of these transactions was structure. Most sales occurred through pre-arranged trading plans filed in advance. These plans reduced speculation about intent and clarified that executives were executing long-term strategies rather than responding to short-term volatility.

Mark Zuckerberg sold $945 million through his foundation under such a plan. Palo Alto Networks CEO Nikesh Arora and Robinhood co-founder Baiju Bhatt each realized over $700 million. The consistency across companies and roles points to a standardized approach to liquidity planning at the executive level.

This methodical behavior reinforces the idea that these sales were planned outcomes of a strong market year, not warning signals. Tech billionaires cashed out $16 billion in 2025 as stocks soared within clearly defined regulatory and strategic frameworks.

What this wave of cash-outs signals for markets and leadership

Large-scale insider selling during a rally often attracts scrutiny. However, the context matters. In 2025, executives sold into strength while markets continued climbing. The common thread was not fear, but opportunity.

For investors and decision-makers, this pattern highlights how executives balance exposure during extended rallies. Liquidity events are increasingly treated as prudent financial management, especially when valuations reach historic levels.

For businesses evaluating leadership incentives, equity compensation, and governance, these events offer practical lessons. Exploring structured advisory perspectives can help organizations navigate similar dynamics. Many leaders turn to platforms like https://uttkrist.com/explore/ to assess strategic, financial, and operational considerations in rapidly shifting markets.

A broader reflection on timing and discipline

Tech billionaires cashed out $16 billion in 2025 as stocks soared, but the deeper story lies in discipline. These executives acted within predefined plans, during favorable conditions, and amid strong market narratives. The result was a synchronized conversion of equity into cash without destabilizing investor confidence.

As markets evolve and AI continues shaping valuations, the balance between holding and monetizing equity will remain a critical leadership decision. How future rallies unfold may depend as much on executive behavior as on technology itself.

Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category: https://uttkrist.com/explore/

In an era of record valuations and rapid innovation, how should leaders decide when holding becomes riskier than selling?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore/