Trump Might Fire Powell as Fed Chair Pick Nears Decision

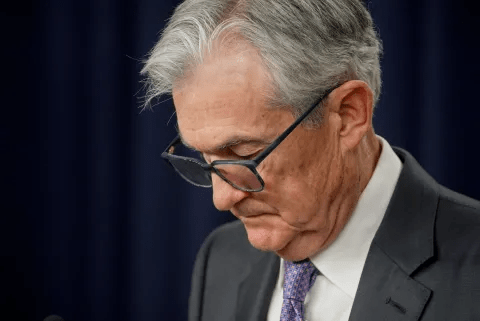

The focus of today’s economic debate is whether Trump might fire Powell as the Federal Reserve chair decision approaches. This issue is shaping market expectations, political strategy, and institutional stability. President Donald Trump stated he has a preferred candidate for the next Fed chair, yet he remains undecided on timing. At the same time, he reiterated dissatisfaction with current chair Jerome Powell.

Trump said his choice would be announced “January sometime.” He confirmed he still has a favorite candidate. However, he also suggested Powell should resign and added he would “love to fire him,” later saying, “Maybe I still might.”

This position places unusual pressure on the central bank leadership. Powell’s term as chair ends in May 2026, while his seat on the Board of Governors runs until 2028.

Potential Successors and Political Signals

The possibility that Trump might fire Powell has revived scrutiny of potential successors. National Economic Council Director Kevin Hassett is viewed as the leading contender. Trump has also expressed interest in former Fed governor Kevin Warsh. Other finalists include Fed governors Christopher Waller and Michelle Bowman and BlackRock executive Rick Rieder.

Trump’s statements remain inconsistent. Earlier in December, he claimed the field had narrowed to one candidate. Later, he said multiple names were under consideration. This oscillation adds uncertainty to policy expectations and market forecasting.

Trump has long criticized Powell, despite appointing him during his first term. His primary objection remains monetary policy direction. He wants the next chair to cut interest rates more aggressively. The administration’s stated goal is to lower mortgage costs across the economy.

Institutional Tension and Legal Friction

Beyond leadership selection, Trump raised the prospect of legal action. He said he was considering a “gross incompetence” lawsuit against Powell over a renovation project at the Federal Reserve. While no filing has occurred, the statement further intensifies the institutional standoff.

If Trump might fire Powell, the implications would be substantial. The central bank’s leadership stability affects interest rate policy, inflation control, and global investor confidence. Uncertainty over succession adds friction to policy planning across financial markets.

In periods of institutional transition, organizations often reassess strategic operations and financial exposure. Many enterprises are now re-evaluating advisory, compliance, and operational support.

Explore the services of Uttkrist. Our services are global in nature and highly enabling for businesses of all types. Drop an inquiry in your suitable category:

https://uttkrist.com/explore/

What Comes Next for the Federal Reserve

Trump’s remarks leave multiple outcomes in play. He could name a successor while Powell remains in office. He could attempt removal. Or he could allow the term to conclude naturally in 2026. Each scenario carries different consequences for monetary governance.

Markets are now watching for January’s announcement. The decision will signal the administration’s future economic posture and its tolerance for institutional confrontation. Whether or not Trump might fire Powell, the episode already underscores how leadership uncertainty at the Federal Reserve can ripple through national and global economic systems.

How should businesses and investors prepare for prolonged uncertainty around central bank leadership and political influence?

Explore Business Solutions from Uttkrist and our Partners’, https://uttkrist.com/explore/