Trump Tariffs Trade Deficit Falls Sharply Amid Market Turbulence

Since returning to office in January, Trump tariffs trade deficit dynamics have shifted fast.

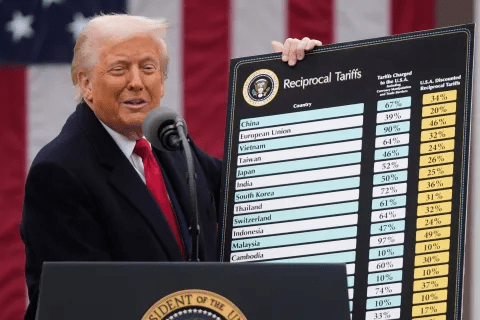

Donald Trump overturned decades of U.S. trade policy by imposing double-digit import taxes on nearly every country. As a result, global commerce absorbed shockwaves, while U.S. consumers and firms faced higher costs.

At the same time, the federal balance sheet showed a surprising turn. The trade deficit narrowed sharply from historic highs, even as economic volatility increased. This reset defined 2025 as one of the most turbulent trade years in recent memory.

Trump Tariffs Trade Deficit and the Effective U.S. Tariff Rate

A key indicator of Trump tariffs trade deficit impact is the effective tariff rate. This metric reflects real imports, not headline announcements.

In 2025, the effective U.S. tariff rate peaked in April, according to Yale Budget Lab data. By November, before final consumption shifts, the rate stood near 17%. That level was seven times higher than January’s average. It also marked the highest rate seen since 1935.

Consequently, tariffs became a direct cost for consumers and businesses. Although rates eased from the April peak, they remained far above early-year levels. Therefore, price pressures persisted throughout the year.

Tariff Revenue Versus the U.S. Trade Deficit

Supporters argued tariffs would fund the Treasury and shrink the deficit. In practice, Trump tariffs trade deficit outcomes were mixed.

Higher import taxes generated more than $236 billion through November. That figure far exceeded prior years. However, it still represented only a fraction of total federal revenue. Importantly, the revenue fell short of claims that tariffs could replace income taxes or fund dividend checks.

Meanwhile, the trade deficit did contract. The monthly gap hit a record $136.4 billion in March. This spike reflected rushed imports ahead of tariff rollouts. By September, the deficit narrowed to $52.8 billion. Even so, the year-to-date deficit remained 17% higher than the same period in 2024.

Trump Tariffs Trade Deficit and Shifting Import Partners

Trump’s 2025 tariffs applied broadly, yet their impact varied by partner. The sharpest effect appeared in trade with China.

U.S. tariffs on Chinese goods reached 47.5%, based on calculations by Chad Bown of the Peterson Institute for International Economics. As a result, imports from China fell nearly 25% in the first three quarters. China dropped to the third-largest source of U.S. imports, behind Canada and Mexico.

At the same time, imports from Mexico, Vietnam, and Taiwan increased year to date. Imports from Canada declined. Thus, trade flows adjusted rather than disappeared.

Market Swings Reflect Trade Policy Volatility

Financial markets mirrored tariff uncertainty. The S&P 500 experienced its biggest daily and weekly swings in April. It also recorded its largest monthly losses in March and gains in June.

These movements aligned closely with abrupt tariff announcements, suspensions, and revisions. Therefore, investors faced rapid shifts in sentiment. The pattern reinforced how trade policy volatility can transmit directly into equity markets.

What the 2025 Tariff Year Signals

The Trump tariffs trade deficit story is not a clean win or loss. The deficit narrowed sharply from a record high. Treasury revenue surged. Yet households absorbed higher prices, and markets endured sharp swings.

For business leaders, the lesson is clear. Trade policy now acts as a first-order risk factor. Supply chains, pricing, and capital markets all respond in real time.

Explore the services of Uttkrist, our services are global in nature and highly enabling for businesses of all types, drop us an inquiry in your suitable category: https://uttkrist.com/explore

As trade policy continues to reset global flows, how should companies balance cost pressures against the need for resilient supply chains?

Explore Business Solutions from Uttkrist and our Partners’, Pipedrive CRM [2X the usual trial with no CC and no commitments] and more uttkrist.com/explore