US Considers Financial Stake in Intel Amid Leadership Scrutiny

Intel’s Leadership and Potential Government Investment

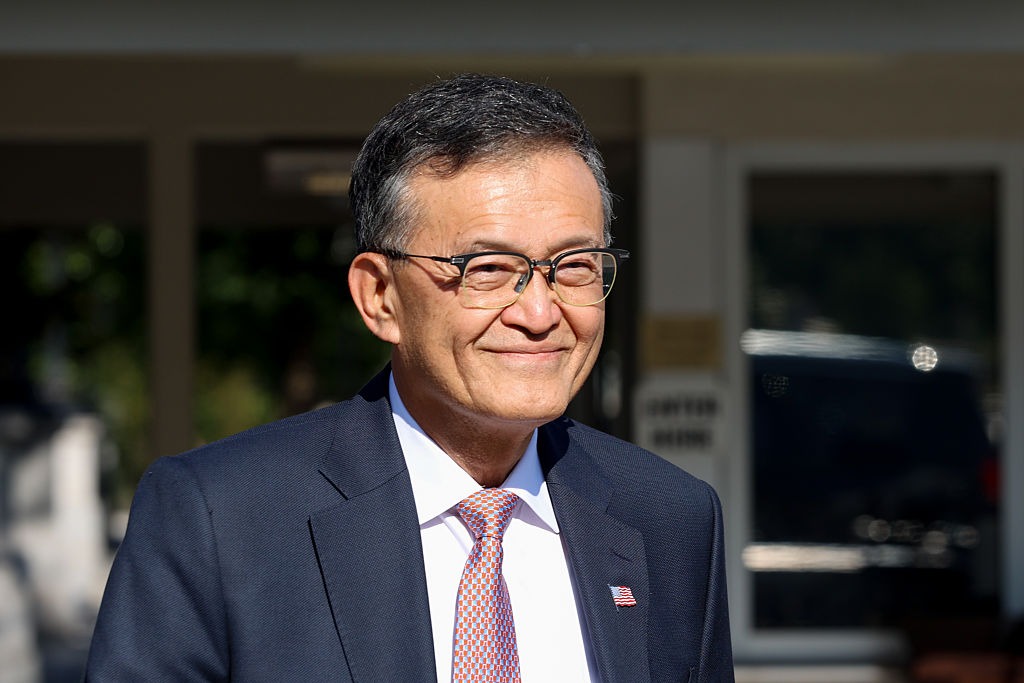

The US government’s potential financial stake in Intel has emerged as a new development in Washington’s tech and manufacturing policy discussions. Sources revealed that President Donald Trump and Intel CEO Lip-Bu Tan discussed the idea at a White House meeting. Although still early-stage and described by Intel as a rumor, the move could reshape the chipmaker’s strategic direction at a time of mounting political and economic pressure.

This discussion follows Trump’s recent call for Tan’s resignation, citing a letter from Senator Tom Cotton. Cotton raised concerns about Tan’s alleged ties to Chinese companies, including stakes in firms linked to China’s People’s Liberation Army, and past leadership of Cadence Design Systems during a period of unlawful technology sales to a Chinese military university.

Political and Market Pressures Intensify

Intel, the largest recipient of CHIPS Act funding at $8 billion, is facing scrutiny not only over its leadership but also its strategic delays. Its planned $28 billion Ohio chip complex, originally set to operate by 2030, is now delayed by five years, disrupting national chip production goals. Trump’s remarks suggest any deal with Tan could support the project’s completion while increasing government influence in the semiconductor sector.

Intel’s valuation has dropped sharply from $288 billion in 2020 to $104 billion today. After reporting its first unprofitable year since 1986, the company appointed Tan to replace long-time CEO Pat Gelsinger. Industry insiders suggest Tan may shift away from Gelsinger’s manufacturing focus, instead targeting next-generation chipmaking to compete with Taiwan’s TSMC, which currently produces about a third of Intel’s supply.

Strategic Risks and Potential Shifts

If Tan executes this pivot, Intel could position itself to win major customers like Apple and Nvidia. However, analysts warn it may require large write-offs—potentially costing billions. This financial risk could make a US investment more attractive, providing stability during the transition.

Such an arrangement would also echo Trump’s approach in other cases, like the proposed TikTok restructuring, where ownership changes were designed to address national security concerns. In Intel’s case, it could involve divestments to meet security and CHIPS Act compliance obligations.

Broader Policy Context and Controversy

Critics argue that targeting Tan mirrors past scrutiny of other Asian CEOs, while supporters frame it as a national security measure. Meanwhile, Representative Raja Krishnamoorthi has raised separate concerns about Trump’s chip export policies to China, questioning whether they undermine US technological advantages.

The outcome of these discussions will shape not only Intel’s recovery strategy but also the degree of direct US government involvement in its semiconductor industry.

Could a US government stake in Intel mark a turning point in American industrial policy, or will it introduce new risks into the tech sector’s competitive landscape?

Explore Business Solutions from Uttkrist and our Partners’, Pipedrive CRM (2X the usual trial with no CC and no commitments) and more uttkrist.com/explore